COVID-19 And Deprivation: A Pilot Study at Food Banks

Rashaad Ali & Dr Helmy Haja Mydin

November 2021

The COVID-19 pandemic brought about a profound public health crisis in Malaysia. This is only eclipsed by its socioeconomic impact that was worsened by the multiple Movement Control Orders (MCO). Malaysians from all walks of life struggle with the immediate, prolonged and endemic impact of the pandemic but as the adage goes, we’re in the same storm but not the same boat.

Our recent socio-economic struggles have seen Malaysian precarity grow to the extent that community-driven efforts emerged to meet the needs of struggling individuals. Organically-driven initiatives such as #kitajagakita and #benderaputih shone a light on the degree of desperation that many faced.

As we continue to reopen safely in the context of an endemic, it is necessary to look back and have a better understanding of the hardship people experienced as a result of the pandemic. This will allow us to look beyond not only the impact on public health, but understanding poverty in general.

Reliance on archaic methods of poverty measurement that do not take a multitude of factors into account need to be discarded. Initiatives such as the Multidimensional Poverty Index study conducted by the Permatang Pauh Parliamentary office are commendable attempts to take a nuanced approach to understanding precisely what makes an individual ‘poor’, especially when adjusted for the COVID-19 reality.

An example of this is how the pandemic has exacerbated existing hardships. Stress associated with the precarity of daily/hourly jobs, being the sole breadwinner, or living in an overcrowded home can be made worse by COVID-19. Affected individuals have to find additional ways to manage this stress, such as decreasing food expenses, going to food banks for their meals or asking other family members to look for work.

Initiating a pilot study

To investigate the experience of different hardships caused by the pandemic, the Social & Economic Research Initiative (SERI) conducted a pilot study at food banks with the support of the Waz Lian Foundation. The study sought to identify the factors associated with the pandemic that drove individuals to seek aid or respite from food banks, alongside identifying stress factors and subsequent coping mechanisms.

This study was conducted between 1-14 July 2021 at food banks in Penang, Kuala Lumpur, Johor and Selangor via a voluntary survey consisting of 14 questions, designed to ask how respondents were affected by the pandemic and the recourse that they took, paying attention to loss of income and the subsequent impact on food security. Food banks were selected as the site for this study, being relevant to the issue of food (in)security and the pandemic. SERI’s survey was disseminated to beneficiaries of food banks set up and operated by Waz Lian Foundation and Hotel Sentral Group at hotels across the country.

As a pilot, the underlying purpose was also to test research techniques and protocols in preparation for a larger, more comprehensive study on the economic effects of COVID-19 on Malaysians.

Respondent demographic

Respondents consisted of women and men between the ages of 15 - 89 years old. Respondents were approached with the questionnaire at the food banks, while care was taken to ensure they were aware that filling in the survey was not a requirement to receive aid or to access the food bank.

The sampling process was not random and we acknowledge limitations in terms of bias to that effect. Majority of the questions were multiple choice, with respondents asked to choose as many responses they felt relevant. In total, 371 recorded respondents were collected. 153 respondents were women, with the remaining 218 being men. 22% of respondents were in their 30s, representing the largest single group, but 47% of respondents were between the ages of 40-69.

Repercussions of COVID-19

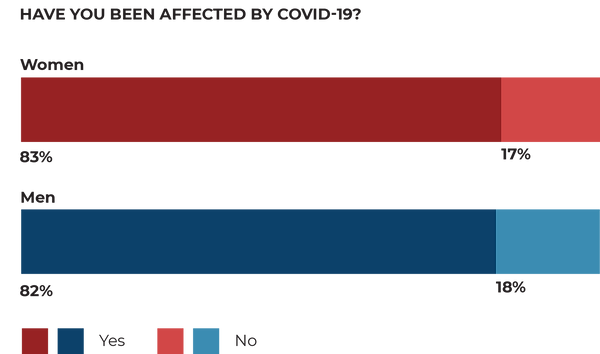

According to our study, 83% of respondents have been adversely affected by the COVID-19 pandemic. Of those affected, the majority 179 (58%) were men, while respondents as a whole were mostly in their 30s (22%). Respondents in other age ranges affected by COVID were fairly evenly distributed (13%-17%). Respondents between the ages of 40-69 affected by COVID totalled 157 (51%), while there was little discrepancy between how the pandemic affected men and women.

Of these, 28% cited a loss of income due to the daily wage/contractual nature of their job as the main stress factor. Others noted the stress and hardship that come with being the sole breadwinner in the family - exacerbated by the precarity of their employment caused by COVID-19. Ten percent of respondents expressed uncertainty over whether they would continue to have a job due to the various iterations of movement control orders (MCO).

75% of responses were employment related, representing the primary area of concern. Another secondary issue that might not have been apparent was the issue of overcrowding - one that is exacerbated by the stay-at-home notice. This also translates into a health issue as many people living in an enclosed space can quickly turn into a COVID health hazard should one person become infected.

Both women and men have sought to address their financial woes with some form of side business while simultaneously searching for new employment opportunities, at 48% and 47% respectively. Women have opted to cook instead of buying food, and have also looked to their children for help more so than their male counterparts. Cooking at home instead of eating out/ordering takeaway has also been a quick and simple fix to reduce daily expenses. The responses indicate a strong preference for finding supplementary income as the main recourse to address the issues brought about by the pandemic.

Financial constraints

In this survey, we measure the extent of precarity using the levels of savings respondents had i.e. how long are people able to hold out for when their source of income is no longer available to them?

While 63% of our total respondents indicated they had some form of savings, 34% did not have any form of savings. The majority of respondents, approximately 48% of respondents had only a couple of months worth of savings. Of those who have money kept away, 15% have less than a month’s worth of savings. Only 13% of total respondents have more than 5 months savings, with most respondents between the 2- 5 months mark. More than half of the respondents rely on personal tabung to keep their money. Women tended to save more than men, and had slightly more savings.

This paints a grim picture of precarity, with most respondents dependent on regular income to prevent disaster. This becomes more problematic when we consider the daily/hourly or contractual nature of most of their jobs. When we consider one-off cash assistance, a lack of savings needs to be taken into account especially if the circumstances of the health crisis dictate a continued lockdown preventing people from working. One-off aid may be woefully insufficient in these cases.

Other than affecting their savings, we asked our respondents how else COVID-19 has impacted their expenditure. More than half of respondents noted a reduction in food and other daily expenses, while around 34% spoke of their difficulties repaying or deferring debt payment. 19% of respondents say they have been forced to borrow funds for their daily needs. The decision to reduce food and daily expenses shows the relevance of food baskets, i.e., why this is a relevant form of aid especially if the food basket is nutritional and affordable.

Respondents resorted to borrowing money mostly for daily needs and food but noticeably also for utilities payment, favoured over education expenses. Women tended to borrow more for utilities payment and school supplies over men, while debt repayment remained a distant need. This suggests the potential effectiveness of debt deferment policies, allowing people to focus on their immediate needs.

Financial constraints

Utility subsidies merit consideration, as 39% of respondents have had to borrow money to pay off these bills. A cash subsidy in this case might be more effective than a percentage discount of 5-10%, which more often than not amounts to a minuscule discount. A RM50 cash subsidy for electricity or water for example, would go a longer way in providing stability and support than a percentage discount of the total bill, thereby alleviating more of the stress on the individual and allowing them to continue paying their utilities on time while sheltering at home.

Similarly, many respondents took to deferring loan payments or borrowing money to pay said loans off, which may suggest the automatic implementation of loan moratoriums - especially at the individual or SME level - could be relevant. The failure to implement a moratorium may nullify any other form of assistance: cash aid or utility subsidy may matter little if one still has to pay off loans without any form of income. Policymakers dithering on this decision may have potentially devastating financial consequences, exacerbating existing precarity.

Tangential to these existing problems are the issues of force majeure, and perhaps the need to consider some form of rent relief. With COVID intensifying these economic problems, the ability for many to fulfil a rental contract or otherwise has come into sharp relief. Ensuring that force majeure, or unforeseen circumstances preventing the fulfillment of a contract, is commonplace in agreements is necessary to prevent exploitation during this time of crisis.

Conclusion

This pilot study attempts to uncover and pull back the curtain on an issue we are already familiar with - the experiencing of different hardships in this pandemic - but perhaps in identifying precisely the kind of hardship faced, we will be able to direct our efforts in more meaningful ways.

Where and what kind of assistance is needed the most? What kind of support do individuals experiencing this difficulty actually need? Is the aid we are providing sufficient? What is relevant, and what is not? Oftentimes in times of crisis we default to what we know, which may not necessarily be beneficial to those most affected, no matter how well-intentioned.

How can we craft policies that are helpful and benefit the most number of people instead of something that may be well intentioned but ultimately ineffective? This basic study demonstrates the different ways in which people are suffering and trying to cope.

Whether at the federal, state or community level, the pressing need to refer to data to inform transformational policies that can mitigate the worst of the pandemic is paramount. Considering how long we have lived in these conditions, the lack of data on its impact is startling. With COVID-19 likely to be endemic, and with future pandemics sure to follow in the future, it is imperative that we develop policies that provide a platform to future-proof society, especially those most vulnerable, from further precarity.

SERI is a non-partisan think tank dedicated to the promotion of evidence-based policies that bridge the gap between the haves & the have-nots. For more information, visit www.seri.my or drop us an email at hello@seri.my